Preferred equity is synthetic leverage.

It combines an equity-like security with a debt-like security. Which one it is depends on the success of the business:

- When things go well, preferred stock converts to standard common equity.

- When things go poorly, preferred stock turns into debt.

In this way, preferred equity exists in a constant state of quantum superposition. It's neither equity nor debt, until it is.

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech

Schrödinger's balance sheet

Erwin Schrödinger was a renowned physicist and one of the first to study the strange world of quantum theory. Among us mortals, he is most known for his famous thought experiment, eponymously called "Schrödinger's cat." In it, he posited that a cat sitting in a box along with a flask of poison could be considered to be both dead *and* alive until we open the box to find out if the flask has shattered, killing the poor kitty.

Preferred equity is like Schrödinger's cat. Open the box: if a startup is very valuable, preferred stock all becomes normal equity. If the box contains a dead or slow growing startup that hasn't created much value, preferred stock becomes debt instead.

You can think about preferred equity as debt combined with a deeply out of the money call option. "Out of the money" is just a fancy way of saying the investor won't make much of a return unless the company gains significant value. If the company creates no value from that point forward, the option component is worthless, and the equity merely becomes debt. If the company creates significant value, the importance of the debt element wanes and the option component dominates the return profile.

Strangely enough, this is the exact reverse of what you'd want to have happen as a founder.

This point has been made by John Cochrane and others in the context of bank capitalization:

Ensuring that banks are funded with significantly more equity should be a key element of effective bank regulatory reform. Much more equity funding would permit banks to perform all their useful functions and support growth without endangering the financial system by systemic fragility.

Things go very wrong when banks are overly-funded with debt, as debt tends not to "fail gracefully" the way equity does. In financial crises, banks "break" in a very hard way due to the significant debt they carry, which must be paid back, necessitating government bailouts in the worst case scenarios. On the other hand, equity tends to break in a soft way: if the company isn't worth anything, nothing is owed. Thus a sudden decline in the value of the company doesn't cause a severe panic.

Cochrane goes so far as to advocate that in times of financial distress, debt on the balance sheet of struggling banks should simply convert to equity rather than be bailed out by the government. Notice what he's proposing – debt on the upside and equity on the downside.

Likewise, as a founder, you'd want your capital structure to be equity when things go badly, making it a variable cost that declines gracefully as your business success declines, and you'd want it to be debt in the upside case, effectively acting as a fixed cost over which you get leverage.

In startup land, however, we do the opposite – we convert equity to debt in times of distress.

Spin up

Preferred equity is more valuable to investors than common equity, so they're willing to pay more for it, necessitating the issuance of fewer shares and leading to less dilution for the company. Thus, relative to raising common equity, preferred equity has a similar benefit as debt, in that it allows you to raise more capital with less dilution.

In this way, startups become synthetically levered. No debt appears on the balance sheet, yet the returns of the common equity (really anyone below the most senior preferred stock) get juiced by the lower cost of capital achieved via preferred equity.

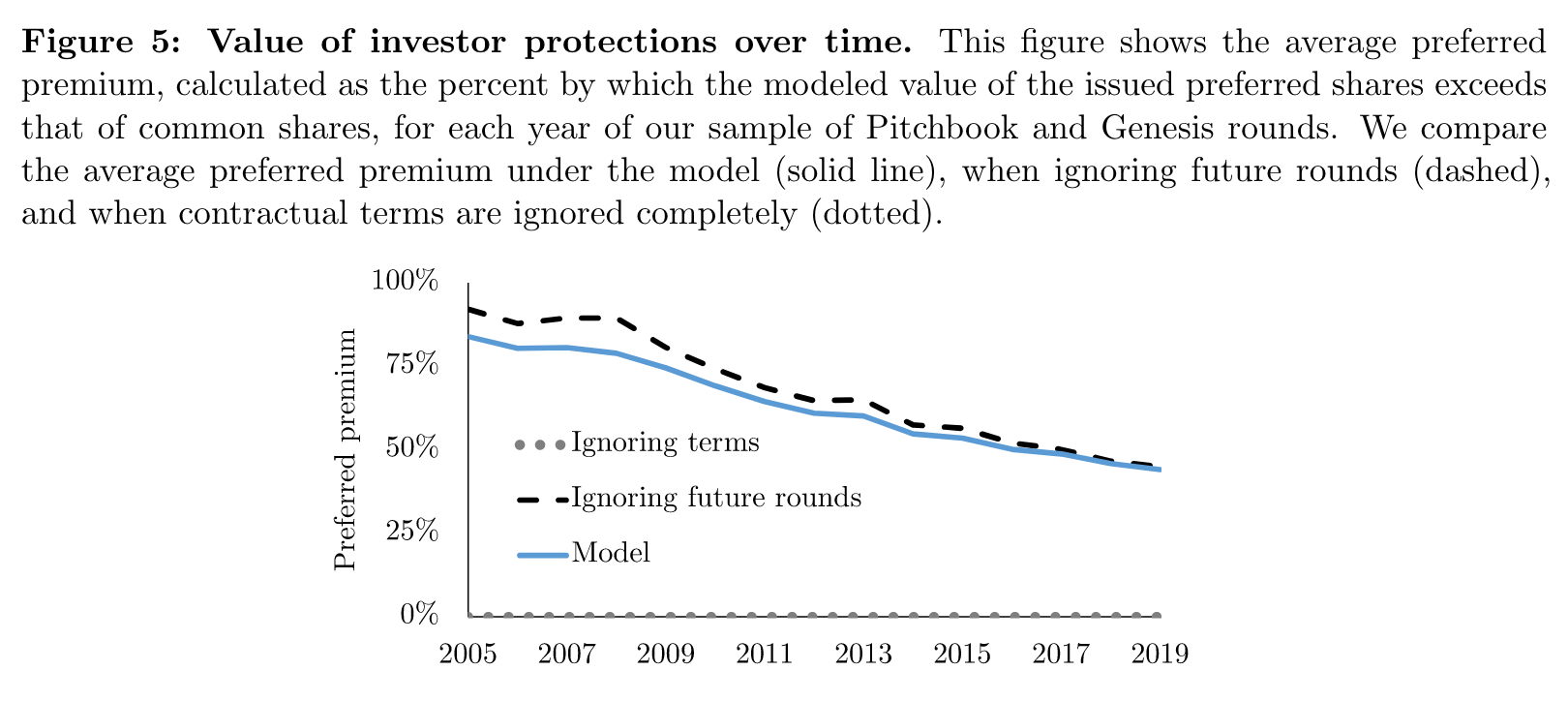

The value of preferred stock can be inferred from its cost, i.e. its premium relative to common equity. The preferred equity premium is rarely laid out explicitly, but researchers at Stanford and the University of British Columbia estimate that these days preferred equity is 50% more valuable than common equity and was even more valuable in the past:

This paper develops the first option pricing model of venture capital-backed companies and their security values that incorporates the dilutive future financing rounds prevalent in the industry. Applying our model to 19,000 companies raising 37,000 rounds shows that preferred contractual features make the most recently issued preferred shares worth on average 56% more than common shares – A Valuation Model of Venture Capital-Backed Companies with Multiple Financing Rounds

A quick illustration: you're a founder, and you know you need to raise roughly $60M to achieve a meaningful outcome. Because preferred equity is worth 50% more to investors than common, you could either raise $60M in preferred stock with some level of dilution, or raise it all in common stock for 50% more dilution. Let's say the common approach would dilute you by 60%. Then raising the same amount via preferred would only dilute you by 40%:

| Preferred | Common | |

|---|---|---|

| Capital raised | $60M | $60M |

| Total shares | 100 | 100 |

| Blended price/share | $1.50 | $1.00 |

| Shares purchased | 40 | 60 |

| Dilution | 40% | 60% |

This obviously makes a massive difference in an upside scenario. Simply put, you get to keep much, much more of your company. When things work out, preferred equity has a higher cost to investors, and a lower cost to startups.

This is obviously great in a bull market. Cheap, bountiful leverage, available oftentimes for a fraction of the painful diligence associated with raising real debt.

The availability of preferred equity drives companies to raise more than they otherwise would. We'll look at such a scenario next.

Spin down

When rates of return are sufficiently low, preferred equity begins to look eerily like debt. When are rates of return lowest? When valuations are highest:

High valuation multiples corresponds to lower returns, and vice versa. After periods of frothy valuations, returns end up lower than expected, bringing lofty valuations multiples back down to reality – Companies Rarely Grow Into Their Valuations

The mountains of preferred equity being layered into private companies follows the same behavioral vein typically seen during the peak of a market cycle, that is, massive overuse and abuse of debt that juices returns. This has predictably disastrous consequences when things go south.

As is common in finance, the problems with debt reveal themselves only once it blows up. In a downside scenario, the returns of common equity holders get crushed by the weight of the liquidation preference attached to preferred equity.

Remember, venture capital investors are willing to pay $1.50 for preferred equity granting the same ownership they could get for $1 of common equity. In an upside scenario, they effectively pay $1.50 for $1's worth of equity. What happens in a downside scenario?

Let's return to our previous example. This time, the company chooses a certain, fixed level of dilution that it's willing to endure, 60%, and raises money up to that point. Since preferred stock can be issued at a premium, the company can raise $90M of it for the same dilution as $60M of common:

| Preferred | Common | |

|---|---|---|

| Capital raised | $90M | $60M |

| Total shares | 100 | 100 |

| Blended price/share | $1.50 | $1.00 |

| Shares purchased | 60 | 60 |

| Dilution | 60% | 60% |

So far so good. The preferred approach gives you $30M more to put to work in the business. But let's say you never quite achieve product-market fit (not uncommon, even among companies that have raised tens of millions of dollars) and you woefully underperform expectations. You never become a unicorn, and the business is sold for only $100M:

- If you only raised common equity, the founders and employees walk away with $40M. Not as much as hoped for, but not bad!

- If you raised preferred however, founders and employees walk away with only $10M, since the equity is now debt, and the investors must receive their "1x liquidation preference" (their "principal" effectively). Brutal.

This may offer a clue into why the hedge funds of the world have moved so swiftly into venture. As sophisticated, multi-asset investors, they are quite used to lower-returning, low-risk credit investing combined with potentially high-returning, high-risk derivatives. Rather than "fish out of water", as they are often portrayed by traditional venture investors, could they in fact be quite shrewd (tiger)sharks?

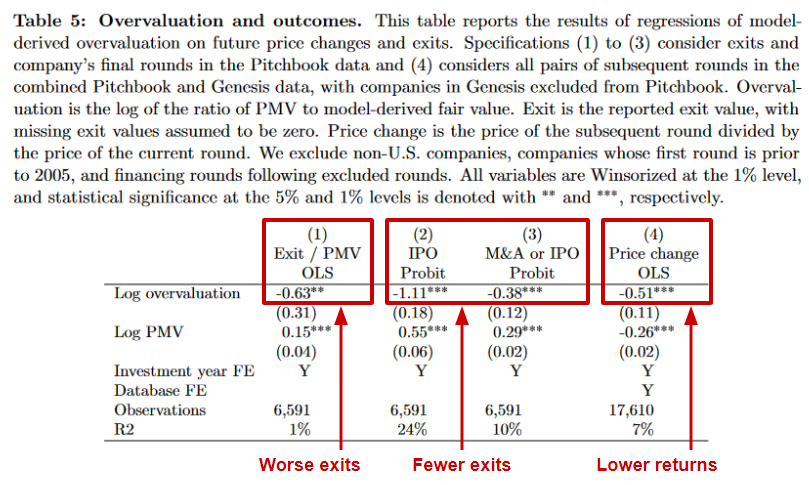

The rabbit hole goes further. Define "overvaluation" as the premium at which preferred stock is valued relative to common equity. Analysis shows overvaluation predicts poor exit outcomes, measured in terms of (1) exit value and (2) the probability of going public or being bought out (note: low R^2 implies exit outcomes are difficult to predict, not that the relationships aren't statistically significant):

… overvaluation predicts low exit outcomes… The extent of this overstatement predicts poor subsequent performance – A Valuation Model of Venture Capital-Backed Companies with Multiple Financing Rounds

Abuse of preferred equity predicts worse outcomes, fewer exits, and lower returns.

Synthetic leverage, as with all forms of financial leverage, makes bad situations even worse AND more likely.

Superposition

Now, let's finally explore the quirky quantum world of superposition.

Preferred equity starts as neither debt nor equity: you have to "open the box" to see if the company is successful. Unfortunately, actions that make your upside better (raising a ton of money and putting it to work in the business) also make your downside worse. Things that look smart in the upside scenario (raising a "war chest") look disastrous in retrospect on the downside. Gain and pain are entangled; success and failure are superimposed on one another.

Perversely, the Silicon Valley ecosystem creates more synthetic debt (i.e. preferred equity) exactly as returns fall:

- Valuations rise

- Companies take advantage by issuing more preferred stock

- Returns fall due to inflated valuations

- Preferred stock converges toward debt

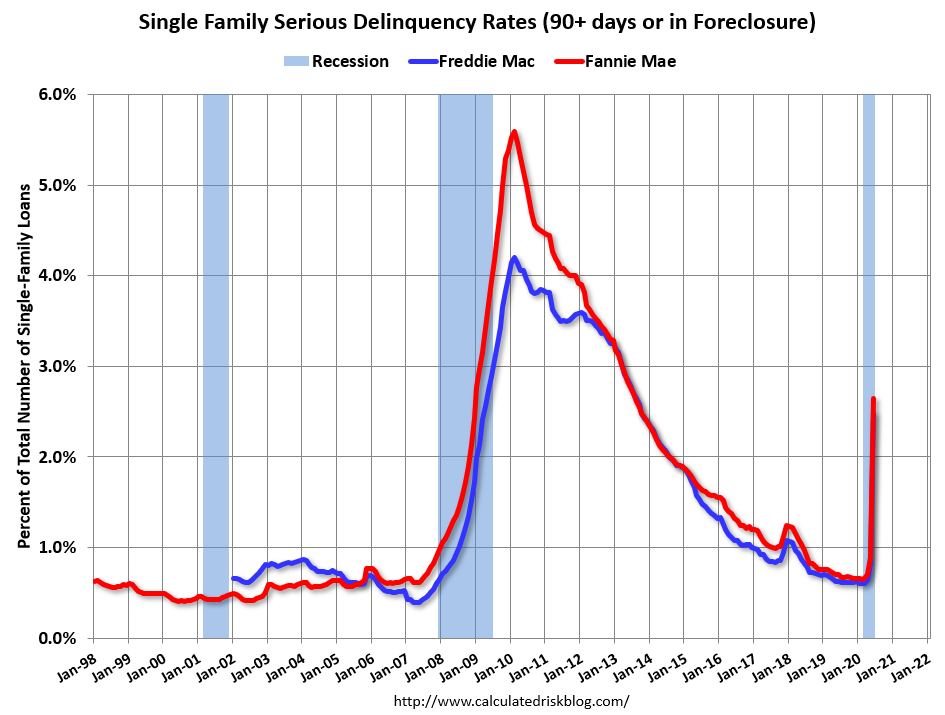

Let's return to financial crises. The capital stack of a company is very similar to that of a home. From the perspective of the founder, common stock is the "equity" in the home and preferred stock is the debt or mortgage. If value of home falls below the principal on the mortgage, the homeowner is "underwater", destroying the value of their equity.

Likewise, when a startup's valuation falls too low, the value comes out of the common shareholders; they get squeezed first. This is most severe in a down round where anti-dilution provisions come into play. This is the Silicon Valley version of a good ol' Wall Street bailout: the debt (preferred) holders get saved, and the equity holders get wrecked.

What tends to happen when homeowners go underwater? We know this from history – they abandon the home:

Now I ask: what might founders and employees do once they are underwater on the preferred equity they've raised?

Equity value motivates founders and employees. If there's no hope for their equity to be worth anything, could we see discouraged founders and employees abandon ship in droves? Even if they don't leave the company entirely, could they effectively go "delinquent" and "check out," significantly reducing their company-focused effort and output?

In startups, we see acceleration of value impairment: as things get worse, they get even worse. Not a great underwriting scenario for a debt-like instrument huh?

Poor performance alone doesn't create a "zombie startup." Zombification requires the total evisceration of team vitality and morale. Thus, Schrödinger's cat becomes Schrödinger's zombie:

"… it's very easy to get into this 'zombie mode,' where your startup is neither truly succeeding nor dying… This is actually worse than failing." – Drew Houston, Founder of Dropbox

Schrodinger's Pandora's box

Imagine you're selling your home and the buyer offers to pay you 50% above the asking price as long as they can get "preferred equity" in your home. You'd be ecstatic about the richer sale price, but you'd also be really curious to know what in the world "preferred equity" is and why it's so valuable to them!

Likewise, as a founder or startup employee, even if corporate finance isn't your favorite topic, you should wonder why investors value preferred equity so highly.

What could investors be so concerned about that they would willingly overpay by 50%? And if they're so concerned, do you think, maybe, you should be too?

Receive my new long-form essays

Thoughtful analysis of the business and economics of tech