Managing risk is hard work.

In evaluating potential opportunities, leaders must consider both probability (the odds of success) and criticality (the importance of success).

We can arrange these opportunities on a matrix, with “necessity for survival” on the x-axis and “probability of success” on the y-axis:

In industry, we often talk about “critical processes”—the things that must go right, otherwise chaos ensues (we go bust, our customers abandon us, we lose our best employees en masse, etc).

Business leaders often fall for the seductive fallacy that “if we only maximize the probability of success” of these critical processes, all will be right in the world:

This is wrong.

Why?

Because over long periods, the only certainty in life is uncertainty.

Even if we achieve a 99% probability of success in a particular critical activity—with time—the 1% outcome will be realized, and we will go bust.

Take banking for example. Prior to the advent of deposit insurance, retail banks went bust with regularity. Any given bank was stable and solvent 99% of the time. However, 1% of the time, some internal or external forcing function would sweep numerous banks into the trash heap overnight.

It didn’t matter that things “worked out” most of the time. Deposits are a capital constraint for the bank. A single run on the bank was enough to bankrupt the firm.

99.9% of days, the banker wakes up at 6am, looks out the window at the bright, rising sun, and goes on with their day.

But inevitably, one evening the banker is rudely roused in the dead of night by the rancorous roar of a mob demanding their money back.

Winning the battle but losing the war

The fundamental error is in seeing the world as:

- static (a single game, never to be repeated -> probability of success dominates -> win the battle, even if pyrrhic) rather than

- dynamic (repeated games, you need to still be alive in order to play -> survival dominates -> survive the battle, win the war)

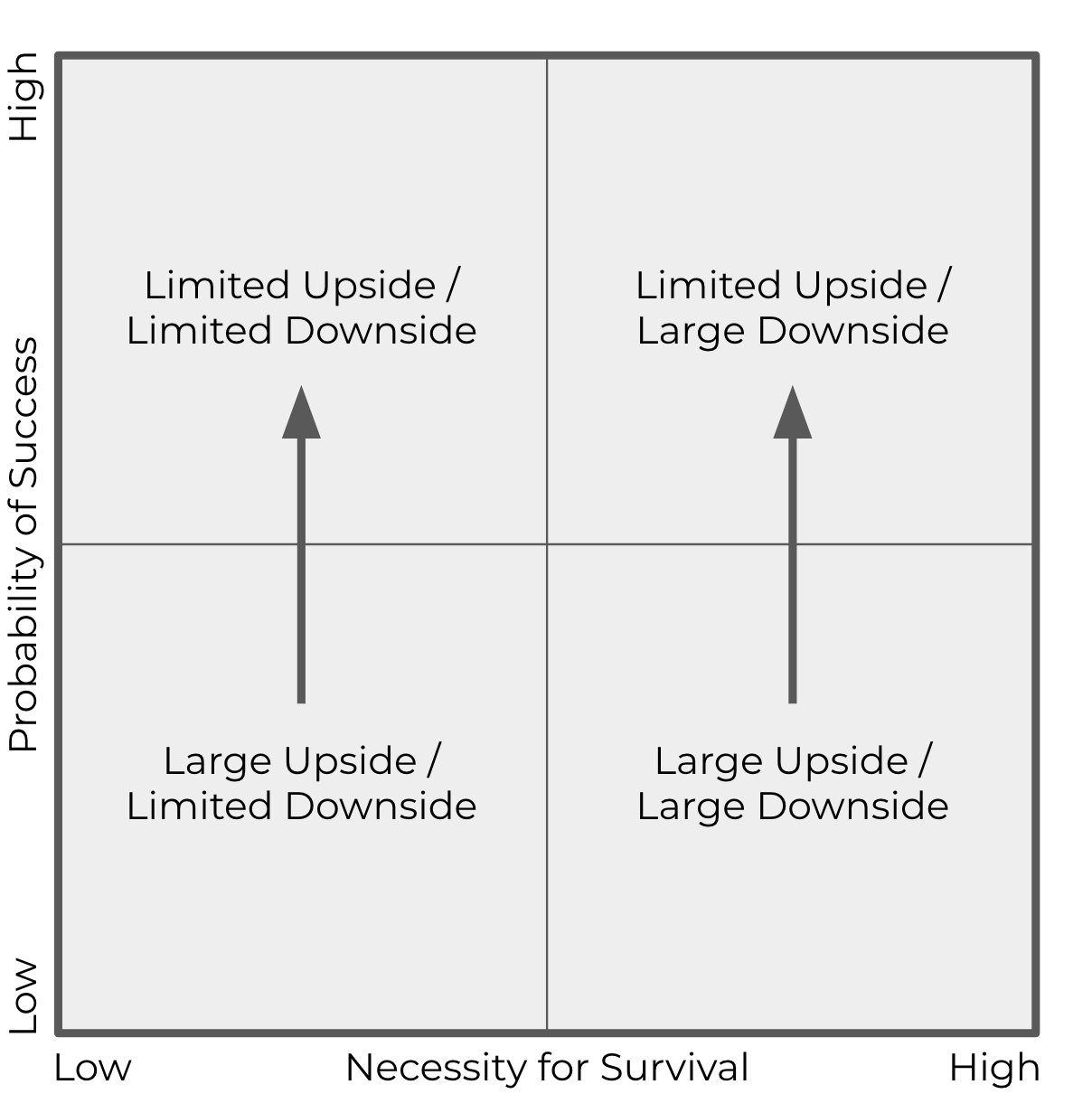

This is why it’s foolish to focus solely on maximizing the probability of success of any given “critical” initiative.

At best, maximizing the probability of success clips your potential upside. If you already know something will work, you can never be positively surprised:

Instead, reduce the number of activities that your business is fragile to or dependent on. We need to cut down the number of critical processes—not maximize the odds of their successful completion.

Survival is the only critical process.

Only by reducing the surface area and impact of potential failure, rather than the odds of failure, do we ensure survival.

How?

Aggressive elimination of single points of failure or vulnerability.

Don’t hate the game, hate the constraint

Commentators describe Silicon Valley and entrepreneurship as a “lottery” or “casino” with stacked odds disfavoring any individual entrepreneur or startup.

The issue is not the game itself, however. The problem is ruin—specifically, gambler’s ruin.

A gambler facing a series of risky bets under a capital constraint will eventually go broke, with certainty. With enough time, the gambler will hit a bad streak, cratering to zero. This can be true even if each bet has a positive expected value.

Like the banks referenced above, the gambler “needs” capital. If the bank account ever hits zero, it’s game over.

The same is true in business, especially early-stage entrepreneurship.

The reason so many startups go bust is not, as is commonly believed, because they have “low odds of success”.

The reason so many startups fail is because they have too many needs.

In other words, startups are too needy.

Many startups today need most or all the following to succeed:

- Product-market fit

- Great founding team

- A+ players

- Positive unit economics

- No economic recession

- Large and growing addressable market

- Low competition

- Venture capital

- Big, marquee, “anchor” customers

- …

The list goes on.

See why startups are so fragile, why most are doomed to fail?

Companies are constrained by their needs. If your company, startup or otherwise, needs every single one, or even most, of the above items to go well, it will not be long for this world.

Eventually, you will fail in some way, and unless you are robust (or even better, antifragile) to these risks, you will go bust with certainty.

I repeat: robust, or go bust.

Hence, “Entrepreneur's Ruin” is the natural bias among business leaders to:

- overweight maximization of probability and predictability and

- underweight rigorous elimination of single points of failure

It's the tendency to see business as:

- “one and done” rather than

- “one times one times one...” compounding ad infinitum

In this multiplicative world, a single zero wipes you out. Prior success is irrelevant. A priori probability or “confidence” of success is also irrelevant.

Like the banker, all that matters is sticking around long enough to see another sunrise.

Needs vs. nice-to-haves

The companies that survive and thrive over the long-term are the ones that keep this “needs list" as short as possible.

The “best” companies do not have the best team, the largest market, the highest profitability etc.

Ironically, the best companies are the ones that get by:

- EVEN THOUGH they don’t have the best team…

- IN SPITE OF a difficult economic environment…

- WITHOUT access to free-flowing venture capital…

And so on.

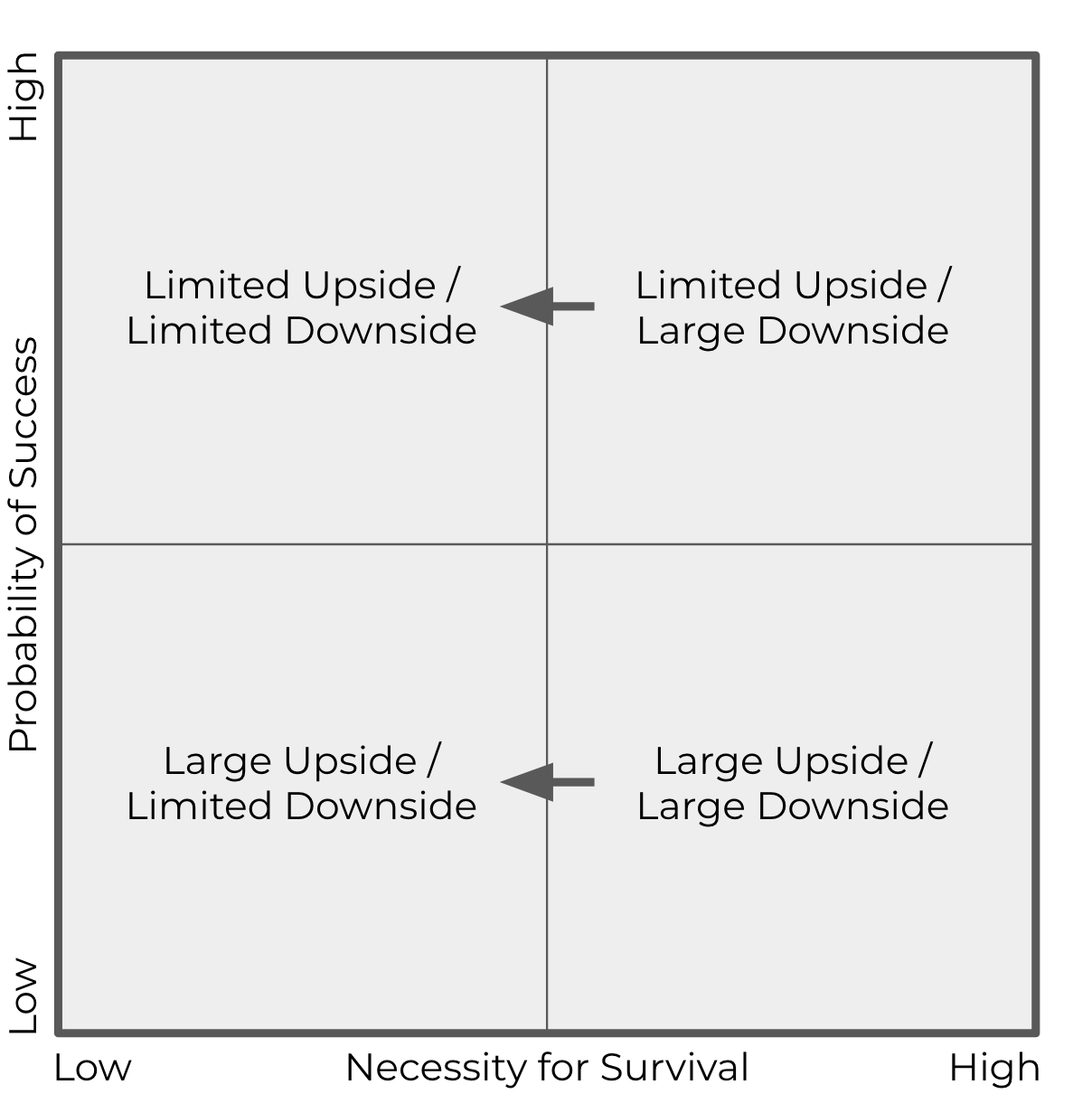

By turning “needs” into “nice-to-haves”, exceptional companies cap their downside while retaining exposure to positive surprises, i.e. upside.

Interviewers love to ask executives about their “keys to success”. In response, CEOs proclaim “XYZ is critical to our success” (insert “culture”, “people”, “operational excellence”, etc).

No. “As little as possible” should be critical to your success.

If you are asked “what are the keys to your success”, the best answer is—paradoxically—“nothing”.

When business leaders, via subtle humble brag, share their “critical strengths”, they aren’t revealing the keys to their success. They are writing their own obituary:

“Bankruptly was a darling Silicon Valley startup admired by all. For most of its tragically short life, Bankruptly had amazing growth, a huge market, and ample capital. But only months after raising a massive round of financing Bankruptly began running into issues. Soon afterward, Bankruptly suddenly…”

You can finish the story.

Don't be needy

One of the primary functions of modern civilization is to guarantee human needs (air, food, water, shelter, community) and in turn create an unlimited number of nice-to-haves (oxygen bars, avocado toast, LaCroix, seasonal homes in Tahoe and the Hamptons, secret societies—you get the point).

With such a multitude of options, life goes from nasty, brutish, and short to bougie, fabulous, and, frankly, too long between seasons of Game of Thrones. Wouldn’t it be great to shorten that bit?

Analogously, great business leaders cut down the list of things that “must go right” and expand the list of things that feel great if they happen but are not particularly painful if they don’t.

In other words, they cap downside while maintaining positive optionality:

In doing so, they increase the effective “money in the bank” or “reserve capital” of the company (the “gambler”), extending its lifespan and paving a longer runway for the kinds of experimentation and random positive luck (“jackpots”) that so often drive business success.

So do what you want in your personal life, but in managing a business, don't be needy. It'll ruin you!